Business

This is how Bank Mergers will impact the Indian economy

Vrinda Agarwal.

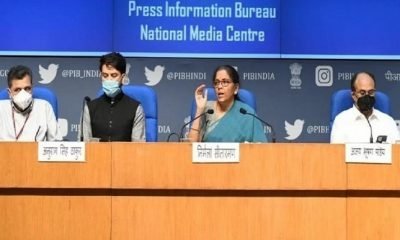

The Government of India on August 30, 2019 announced the amalgamation of ten public sector banks into four mega structures. This news was announced by the Finance Minister of India, Mrs Nirmala Sitharaman and the Reserve Bank of India notified it later as the new structure will come into force from 1st April, 2020. After the amalgamation the number of nationalised banks will be reduced to twelve. The four large entities will have a strong government footprint in the financial sector and also enhanced global reach. Creation of mega sized banks through consolidation will felicitate the present government’s resolve to make India a USD 5 Trillion economy by the year 2024-25. This specific step was taken by the government due to the success it achieved by merging Vijaya Bank and Dena Bank with Bank of Baroda in April 2019 and prior to that in April 2017 five associate banks of SBI and Bharatiya Mahila Bank were merged into State Bank of India.

The merger of United Bank of India and Oriental Bank of Commerce with Punjab National Bank will make it the second largest PSB. It was decided to merge Syndicate Bank with Canara Bank while Allahabad Bank will amalgamate into Indian bank which will be a North- South connection. Similarly, Andhra Bank and Corporation Bank are to be consolidated with the Union Bank of India which has a dominant presence in the eastern market. The total capital infusion of the Punjab National Bank will be Rs. 16000 crore, Canara bank Rs. 6,500 crore, Union bank with Rs. 11,700 crore and the Indian Bank which has the least capital infusion of Rs. 2500 crore. This merger will not only manage the capital more efficiently but also the bigger banks created would have a wider reach, stronger leading capacity and better products and technology to serve customers across India. The amalgamation of PSBs is also based on bad loans intensity and regional factors. Moreover all the banks have a mixed loan portfolio and therefore there would be minimal change in loan mix of the combined entity.

Violation of Lockdown: Nitish Kumar slams UP Govt for sending buses to Kota

The benefits of the merger will lead to reduction in the cost of operations. The merger would help in financial inclusion and broadening the geographical reach of the banking operation. Due to the merger there seems to be a bigger capital base and higher liquidity and hence there would be a reduced burden on the government of recapitalising the PSBs from time to time. The disparity in wages for bank staff will get reduced and their services will reduce.

Although there are certain negative effects as well, since large banks might be more vulnerable to the ensuing global economic crises. Many banks have a regional audience and this idea will be destroyed by mergers. This exercise can be a temporary relief but the real problem like that of bad loans and poor governance may continue to exist.

The countdown has begun. The big bank mergers may fructify over the next 12-18 months. The integration process will be long drawn but hopefully it will boost the economy of our country.